China Is Why Gas Prices Are Going Up And Heading Much Higher

Page 1 of 1

China Is Why Gas Prices Are Going Up And Heading Much Higher

China Is Why Gas Prices Are Going Up And Heading Much Higher

China Is Why Gas Prices Are Going Up And Heading Much Higher

Jason Tlllberg - Feb 25 2013, 14:42

I was working at a grocery store when I was 16 and 17 back in the mid 1990s. I earned

$6 an hour and I could get a gallon of gas for about $1.25. In my

senior year at high school, I drove from Long Island to Vermont in the

winter to go skiing and then in the spring, I drove to Florida. I had a

job, and that meant I needed a car. Gas was for the most part pretty

cheap and it wasn't something I concerned myself about.

Today, I do concern myself with the price of gas.

Also

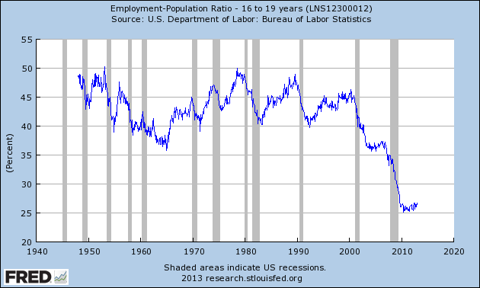

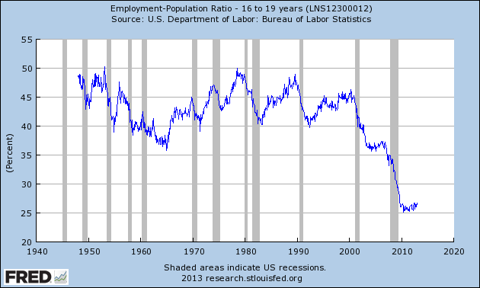

today, the youth in America are mostly without jobs. Take a look at

this chart showing the employment to population ratio of 16-19 year olds

in the U.S.:

(click to enlarge)

Since 2000, youth employment has plummeted during recessions and never seemed to recover. No job more or less means no car.

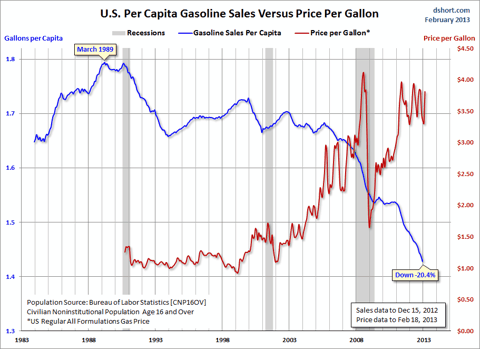

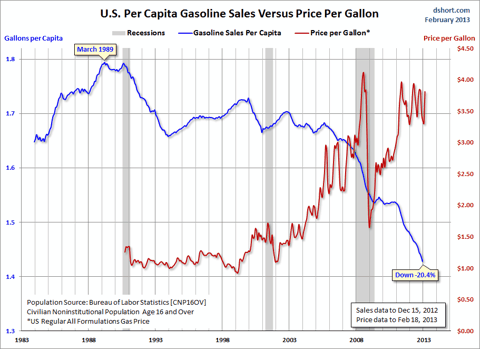

This is just one reason for the apparent collapse in gasoline we've been seeing in the U.S. that I would argue began in 2000. Doug Short puts out this great chart of gasoline sales per capita in the U.S. vs. price per gallon:

(click to enlarge)

Demand

for gasoline in the United States has collapsed and it's not improving,

especially on a per capita basis. More fuel efficient cars is one

thing, but "I can't afford the gas" is another and more influential

factor in our collapse in gasoline consumption.

Just last year, in 2012, we shuttered four refineries, taking the total operable refineries down from 148 to 144. The United States had 301 operable refineries in 1982.

Here is a chart of operable refineries in the U.S. since 1982:

(click to enlarge)

As

for total number of passenger vehicles registered in the U.S.,

according to the National Transportation Statistics, the following

number of vehicles were registered in the following years:

2008: 255,917,663

2009: 254,212,610

2010: 250,272,812

Data only go out to 2010, but as you can tell, we're junking more cars in the U.S. than we're

buying. In essence, every car that is bought in the U.S. today is a

replacement car, or more relevant, a replacement gas tank.

Shifting

now to China, a nation whose car production growth was pitiful

throughout the 1990s, changed the tune once it joined the WTO in November of 2001.

To give justice to China's growth, this is what the auto production looked like in the following years:

1990:

China produced 509,242 vehicles

U.S. produced 9,782,997 vehicles

Japan produced 13,486,796 vehicles

2000:

China produced 2,069,069 vehicles

U.S. produced 12,799,857 vehicles

Japan produced 10,140,796 vehicles

Now

is where China comes on board big time. In 2011, China produced

18,418,876 vehicles. The U.S. produced only 8,653,560 vehicles.

According to People's Daily Online,

a Chinese news organization, in 2012, the number of registered private

cars reached 53.08 million units by the end of 2012. This was up 22.8%

from a year earlier!

That same article points out that the

aggregate motor vehicles registered in China exceeded 120 million, which

was up 14.3% from a year earlier. I calculate that's 11.9 million new

gas tanks.

So, as America is junking more cars than it's buying,

as indicated in the total registered vehicle numbers out to 2010, we are

reducing the number of gas tanks on the road. China meanwhile is adding

gas tanks and adding them at break neck speed.

In the month of January,

which was the first month in this year of the snake, passenger car

sales in China hit 1.49 million units, which was an increase of 53% from

the year before. Sounds like more new gas tanks just hit the road.

Global

oil production, on a global per capita basis, has not improved at all

since 1990. Here is a chart of barrels of oil produced per year per

capita in the world:

(click to enlarge)

Source: World Bank and EIA

In

essence, without increases in oil production on a per capita basis,

with China's relentless demand for gasoline to fuel vehicles, supply is

going to be tight and thus, prices are going to remain elevated and

likely head higher in U.S. dollar terms in the years ahead.

What's an American investor to do?

Start with your own vehicles you currently drive. Make sure you get the best gas mileage you can get on the vehicle you drive. Cars.com put out a list of vehicles that get the best gas mileage. This list includes cars made by General Motors (GM), Ford (F), Honda Motor (HMC) and Toyota (TM).

Second, given this circumstance, it makes sense to begin to look at the alternative car companies like Tesla Motors (TSLA), which manufactures electric vehicles and BYD Company (BYDDY.PK),

China's electric car company for either investment in the stock or

investment in one of their vehicles, if not now than in the future

perhaps.

In conclusion, I don't expect gas prices to ever be low

again. The future demand from China alone will cause prices of gasoline

in U.S. dollars to rise more and more in the years ahead.

Jason Tlllberg - Feb 25 2013, 14:42

I was working at a grocery store when I was 16 and 17 back in the mid 1990s. I earned

$6 an hour and I could get a gallon of gas for about $1.25. In my

senior year at high school, I drove from Long Island to Vermont in the

winter to go skiing and then in the spring, I drove to Florida. I had a

job, and that meant I needed a car. Gas was for the most part pretty

cheap and it wasn't something I concerned myself about.

Today, I do concern myself with the price of gas.

Also

today, the youth in America are mostly without jobs. Take a look at

this chart showing the employment to population ratio of 16-19 year olds

in the U.S.:

(click to enlarge)

Since 2000, youth employment has plummeted during recessions and never seemed to recover. No job more or less means no car.

This is just one reason for the apparent collapse in gasoline we've been seeing in the U.S. that I would argue began in 2000. Doug Short puts out this great chart of gasoline sales per capita in the U.S. vs. price per gallon:

(click to enlarge)

Demand

for gasoline in the United States has collapsed and it's not improving,

especially on a per capita basis. More fuel efficient cars is one

thing, but "I can't afford the gas" is another and more influential

factor in our collapse in gasoline consumption.

Just last year, in 2012, we shuttered four refineries, taking the total operable refineries down from 148 to 144. The United States had 301 operable refineries in 1982.

Here is a chart of operable refineries in the U.S. since 1982:

(click to enlarge)

As

for total number of passenger vehicles registered in the U.S.,

according to the National Transportation Statistics, the following

number of vehicles were registered in the following years:

2008: 255,917,663

2009: 254,212,610

2010: 250,272,812

Data only go out to 2010, but as you can tell, we're junking more cars in the U.S. than we're

buying. In essence, every car that is bought in the U.S. today is a

replacement car, or more relevant, a replacement gas tank.

Shifting

now to China, a nation whose car production growth was pitiful

throughout the 1990s, changed the tune once it joined the WTO in November of 2001.

To give justice to China's growth, this is what the auto production looked like in the following years:

1990:

China produced 509,242 vehicles

U.S. produced 9,782,997 vehicles

Japan produced 13,486,796 vehicles

2000:

China produced 2,069,069 vehicles

U.S. produced 12,799,857 vehicles

Japan produced 10,140,796 vehicles

Now

is where China comes on board big time. In 2011, China produced

18,418,876 vehicles. The U.S. produced only 8,653,560 vehicles.

According to People's Daily Online,

a Chinese news organization, in 2012, the number of registered private

cars reached 53.08 million units by the end of 2012. This was up 22.8%

from a year earlier!

That same article points out that the

aggregate motor vehicles registered in China exceeded 120 million, which

was up 14.3% from a year earlier. I calculate that's 11.9 million new

gas tanks.

So, as America is junking more cars than it's buying,

as indicated in the total registered vehicle numbers out to 2010, we are

reducing the number of gas tanks on the road. China meanwhile is adding

gas tanks and adding them at break neck speed.

In the month of January,

which was the first month in this year of the snake, passenger car

sales in China hit 1.49 million units, which was an increase of 53% from

the year before. Sounds like more new gas tanks just hit the road.

Global

oil production, on a global per capita basis, has not improved at all

since 1990. Here is a chart of barrels of oil produced per year per

capita in the world:

(click to enlarge)

Source: World Bank and EIA

In

essence, without increases in oil production on a per capita basis,

with China's relentless demand for gasoline to fuel vehicles, supply is

going to be tight and thus, prices are going to remain elevated and

likely head higher in U.S. dollar terms in the years ahead.

What's an American investor to do?

Start with your own vehicles you currently drive. Make sure you get the best gas mileage you can get on the vehicle you drive. Cars.com put out a list of vehicles that get the best gas mileage. This list includes cars made by General Motors (GM), Ford (F), Honda Motor (HMC) and Toyota (TM).

Second, given this circumstance, it makes sense to begin to look at the alternative car companies like Tesla Motors (TSLA), which manufactures electric vehicles and BYD Company (BYDDY.PK),

China's electric car company for either investment in the stock or

investment in one of their vehicles, if not now than in the future

perhaps.

In conclusion, I don't expect gas prices to ever be low

again. The future demand from China alone will cause prices of gasoline

in U.S. dollars to rise more and more in the years ahead.

- Join date : 1969-12-31

Similar topics

Similar topics» Where we are heading....

» Where We Are Heading - Planetary Crisis

» What does "Communist China" Mean?

» WALL STREET!!! Causing our high gas prices!

» Lower wind and solar prices to usher speedier adoption

» Where We Are Heading - Planetary Crisis

» What does "Communist China" Mean?

» WALL STREET!!! Causing our high gas prices!

» Lower wind and solar prices to usher speedier adoption

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum